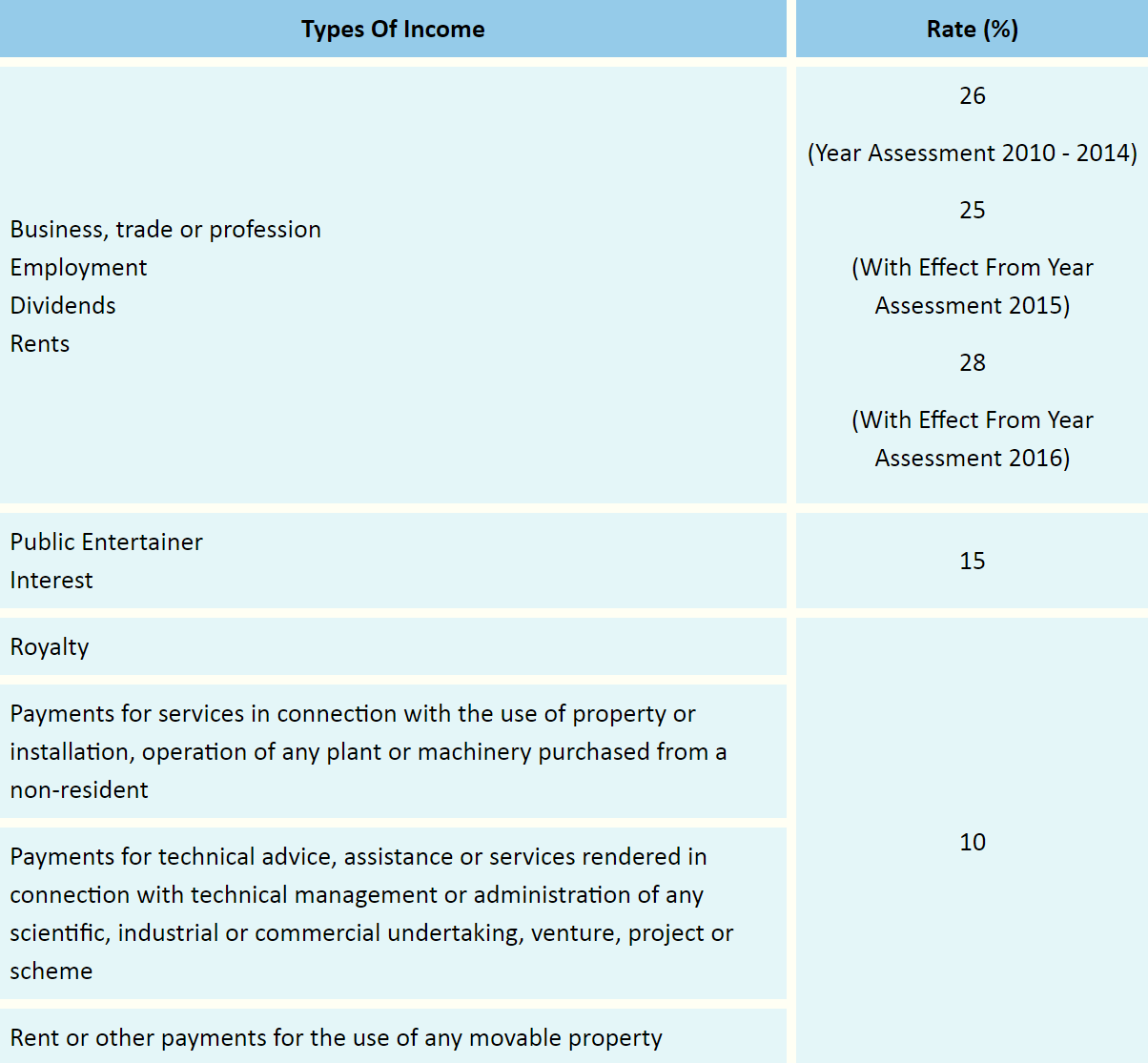

Payment for services rendered in Malaysia in connection with use of property or installation or operation of any plant. Individual Life Cycle.

Pin On Doing Business In Singapore

Social security Liability for social security What Malaysia has is a compulsory savings scheme EPF and an employee protection scheme SOCSO for Malaysian employees.

. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Income earned by residents are subjected to a scaled income tax rates from 0 to 28. Determination of Residence Status of Companies.

A non-resident individual is subject to a flat tax of 30 percent on their entire taxable income regardless of where they live. Do foreigners have to pay taxes in Malaysia. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia.

Non-resident companies are liable to Malaysian tax when it carries on a business through a permanent establishment in Malaysia and assessable on income accruing in or derived from Malaysia. Fees for technical or management services performed in Malaysia. Tax rates range from 0 to 30.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Going to or leaving Malaysia 2020 income tax rates for residents Non-residents are subject to withholding taxes on certain types of income. Payment for services rendered in Malaysia in connection with use of property or installation or operation of any plant machinery or other apparatus purchased from a non-resident person.

Introduction Individual Income Tax. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Real Estate Investment Trust REIT.

Resident means resident in Malaysia for the basis year for a year of assessment YA by virtue of section 8 and subsection 61 3 of the ITA. Personal Reliefs Residents are entitled to a number of personal reliefs that would lower their final chargeable income which is subjected to income tax. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system.

For year of assessment 2022 only a special one-off tax will be imposed on companies excluding companies which enjoy the 17 reduced tax rate above which have generated high income during the COVID-19 pandemic as follows. Advance Pricing Arrangement. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in.

Based on the Income Tax Act 1967 a non-resident of Malaysia will be liable to payment of withholding tax on interest income if he derives interest rates from loans in Malaysia. A non-tax-resident individual would be taxed at a flat rate of 30 percent. Non-Resident means other than a resident in Malaysia by virtue of section 8 and subsection 61 3 of the ITA.

Ltd a foreign company earns interest income from its subsidiary. The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2022. Rate Business Rental.

Other income is taxed at a rate of 30. What is the non resident tax rate in Malaysia. Income Tax in Malaysia in 2022.

Non-tax-residents are not entitled to personal relief deductions. Whereas for non-residents income earned would be subjected to a flat tax rate of 28. Non-Resident Company Tax Rates.

Payment for services rendered in Malaysia in connection with use of property or installation or operation of any plant machinery or other apparatus purchased from a non-resident person. A non-resident tax payer. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Non-resident company tax rates. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. Here I will share 4 things Yamae needs to know about withholding tax on interest income if Mochiko Co.

Someone who hasnt spend 182 days in a year in Malaysia. The maximum tax rate is 30 percent 1. Taxable Income MYR Tax Rate.

Be aware that if within the evaluated 182 days or less period that you are trying to re-qualify to resident tax status you are allowed 14 days out of Malaysia for social visits only. Dividend Franked Dividend Single tier 25 0. Payer refers to an individualbody other than individual carrying on a business in Malaysia.

For 2022 tax year.

Top 8 Countries With No Income Tax That You Should Know

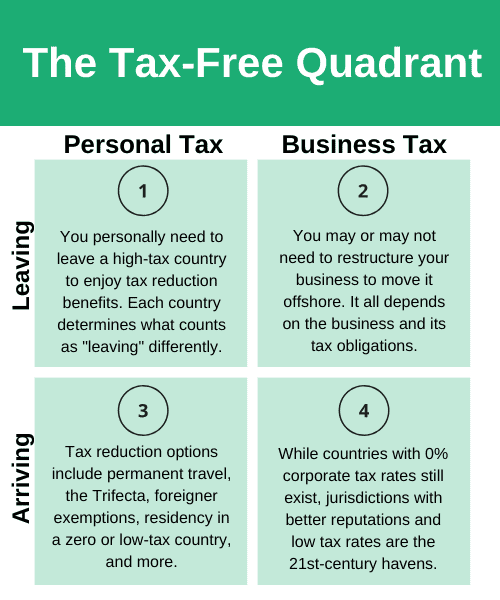

What Is Tax Residence And Why Does It Matter

Pros And Cons Of Starting A Business In Malaysia S F Group Malaysia Starting A Business Business Visa

Nre Vs Nro Vs Fcnr Which Savings Or Fixed Deposit Account Nri Should Open

10 Things Nri Should Know About Portfolio Investment Scheme Pis Nri Saving And Investment Tips Investing Investment Tips Savings And Investment

Different Types Of Income Tax Assessments Under The Income Tax Act

Malaysian Tax Issues For Expats Activpayroll

Tax Guide For Expats In Malaysia Expatgo

Wholesale Retail Trade Wrt License In Malaysia

Tax Guide For Expats In Malaysia Expatgo

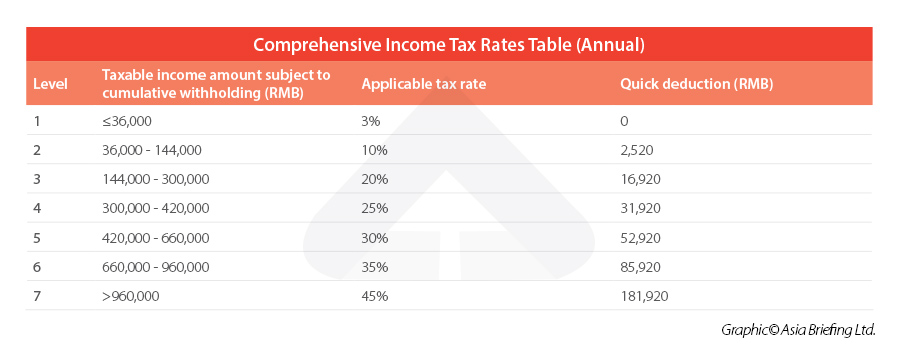

China Annual One Off Bonus What Is The Income Tax Policy Change

Effects Of Income Tax Changes On Economic Growth

Individual Income Tax In Malaysia For Expatriates

How Is Taxable Income Calculated How To Calculate Tax Liability

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Healy Consultants Favourite Offshore Jurisdictions 2015